TRADE MARKETS was established in 2013, making it a relatively new entrant to the online trading industry. Despite its relatively short history, the broker has already gained a reputation for offering a wide range of trading instruments and account types, as well as competitive trading conditions and advanced trading platforms. TRADE MARKETS is headquartered in Cyprus and is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC).

TRADE MARKETS Pros & Cons

Pros:

- Wide range of account types to choose from.

- Both MetaTrader 4 and Trade Markets Trader platforms available.

- Portfolio Manager can help traders develop the best trading strategy.

- Competitive spreads and low commissions.

- Multiple payment methods available.

- Educational resources and tools available to traders.

- 24/7 customer support.

Cons:

- Limited regulatory oversight.

- No demo account available.

- Limited information available on the company’s background and ownership.

- Limited research tools compared to other brokers.

- No cryptocurrency trading available.

Who Is TRADE MARKETS Recommended For?

TRADE MARKETS is recommended for traders of all experience levels who are looking for a broker with a wide range of account types and trading platforms. The broker’s Portfolio Manager can also be helpful for traders who want assistance in developing their trading strategy. Additionally, TRADE MARKETS may be a good option for traders who prefer to trade with a broker that is regulated by a reputable authority.

Top TRADE MARKETS Features

- Portfolio Management: Trade Markets offers a Portfolio Manager that can help you develop the best trading strategy possible based on your expectations and risk tolerance. The portfolio manager is responsible for identifying investment opportunities, tracking the portfolio’s performance, exiting investments at the right moment, and seeking new investments. The objective of a portfolio manager is to optimize the portfolio to seek opportunities in the market while limiting risk.

- Concierge Trading Services: With Concierge Trading Services, you are assigned a Personal Trader who is responsible for taking care of your investment and trading strategies. Your Personal Trader will develop strategies based on your risk profile, giving you insight on how to navigate the markets.

- Forex and CFD Trading: Trade Markets offers a variety of assets to trade, including Forex and CFDs. The access is 24/5, giving you a wide range of times at which you can trade. There are major, minor, and exotic currency pairs for Forex trading. All in all, there are seven majors, fourteen minors, and thirty-three exotics. Spreads for majors start at 3 pips, while spreads for minors start at 4 pips and exotics 25 pips.

- Asset Classes: Trade Markets offers a range of asset classes, including commodities, stocks, and indices. For commodities, you can trade seventeen different assets, including gold and silver. For stocks, there are two-hundred available, such as Google and Amazon. You can trade twenty-four indices, with major indices like Dow Jones 30 and S&P two of the most prominent.

- Stock Purchasing: Trade Markets offers access to hundreds of stocks. You can benefit from “lower pricing,” the more you trade. If you use the popular MetaTrader 5 platform, you can view real-time data as you earn dividends, hedge positions, and receive market research. There are three stock sessions to know with Trade Markets: the Asian, European, and U.S. sessions.

- Fees: With stocks, the fees vary. For $0 to $10,000, you’ll pay a 10% fee. For $10,001 to $50,000, you’ll pay a 7.5% fee, and for amounts greater than $50,001, you’ll pay a 5% fee. There is a 2% p.a. custodian fee, but it is free to rent the platform, and there is no data fee.

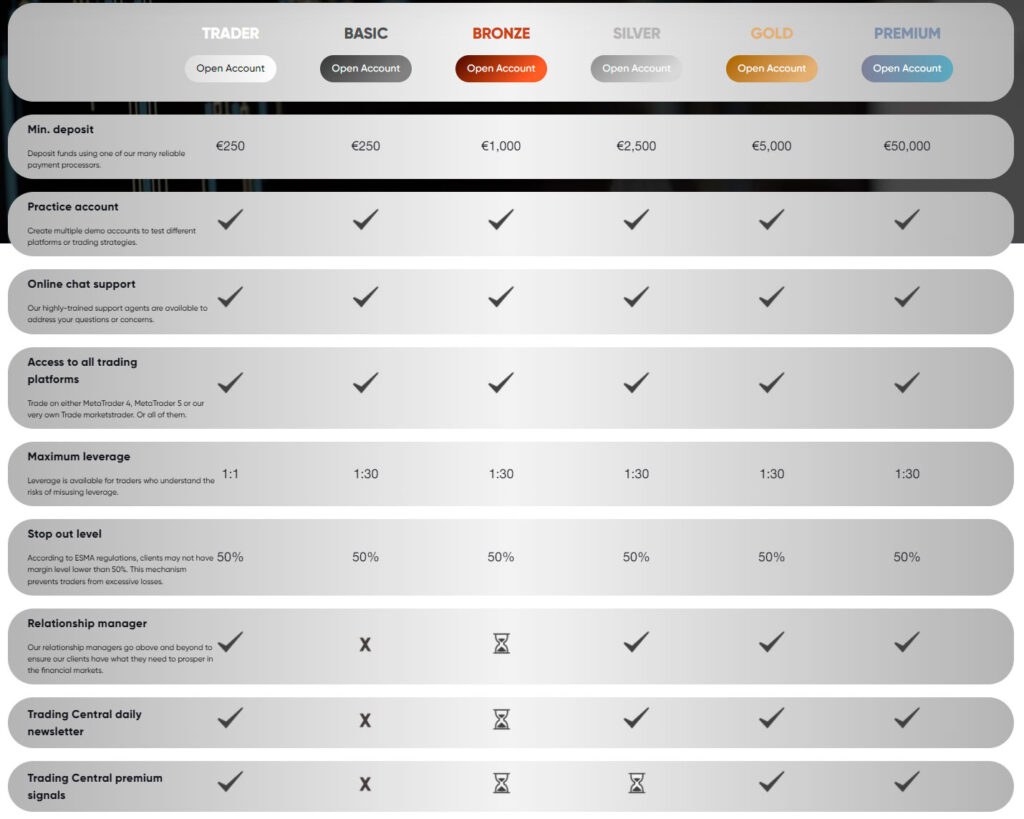

TRADE MARKETS Account Types

The TRADE MARKETS platform offers several account types to cater to the varying needs and preferences of traders.

The Basic account has a minimum deposit of $250, offers a maximum leverage of 1:30, and provides online chart support, online chat support, a relationship manager, Trading Central daily newsletter, Trading Central premium signals, unlimited one-on-one trading academy sessions, and VIP services.

The Premium account has a higher minimum deposit of $50,000, offers the same maximum leverage of 1:30, and provides all the features of the Basic account with lower commission per trade ($7 per lot).

The Silver, Gold, and Bronze accounts have different features, minimum deposit amounts, and commission per trade rates. The Silver account has a minimum deposit of $2,500, offers a maximum leverage of 1:30, and provides online chat support, a relationship manager, Trading Central daily newsletter, Trading Central premium signals (trial period), three one-on-one trading academy sessions, VIP services (trial period), and copy trading support.

The Gold account has a higher minimum deposit of $5,000, offers the same maximum leverage of 1:30, and provides all the features of the Silver account with lower commission per trade ($10 per lot) and an additional one-on-one trading academy session.

The Bronze account has the lowest minimum deposit of $1,000, offers the same maximum leverage of 1:30, and provides online chat support, a relationship manager (trial period), Trading Central daily newsletter (trial period), Trading Central premium signals (trial period), one one-on-one trading academy session, and copy trading support.

All the account types offer a demo account, support up to five decimal pricing, provide 48 Forex (FX) and CFD trading instruments, and do not offer swap/rollover-free trades. However, the maximum and minimum lot sizes per trade are unlisted.

TRADE MARKETS Compliance & Regulation

TRADE MARKETS is a trading name of Leadcapital Markets Ltd, which is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 227/14. This means that the company must adhere to strict regulatory guidelines set by CySEC to ensure the protection of traders’ funds and fair trading practices.

In addition, TRADE MARKETS is also a member of the Investor Compensation Fund (ICF), which is a scheme that provides traders with compensation if the broker is unable to fulfill its financial obligations. The ICF covers eligible claims up to €20,000 per trader.

TRADE MARKETS also follows international regulations, including the Markets in Financial Instruments Directive (MiFID) and the European Securities and Markets Authority (ESMA). These regulations aim to protect investors, promote transparency, and ensure the integrity of financial markets.

TRADE MARKETS Reliability & Security

TRADE MARKETS is committed to providing a secure and reliable trading environment for its clients. They use advanced security measures to protect their clients’ funds, personal information, and transactions.

To ensure the security of clients’ funds, TRADE MARKETS maintains segregated accounts for client funds, meaning that clients’ funds are kept separate from the company’s funds. This helps to protect clients’ funds in the event of financial difficulties or insolvency of the company. Additionally, TRADE MARKETS uses advanced SSL encryption technology to protect all online transactions and data transfers.

TRADE MARKETS also has strict verification and authentication procedures for client accounts. Clients are required to provide personal identification and address verification documents before opening an account, and these documents are carefully reviewed by the company’s compliance team. This helps to prevent identity theft and fraud.

In terms of reliability, TRADE MARKETS uses advanced trading technology to ensure fast and reliable trade execution for its clients. They also offer 24/5 customer support to assist clients with any trading issues or questions they may have. Overall, TRADE MARKETS is committed to providing a safe and reliable trading environment for its clients.

Conclusion on TRADE MARKETS

Trade Markets appears to be a reputable online trading platform that offers a variety of account types, trading instruments, and educational resources to its clients. The platform is regulated by several respected financial authorities, indicating a commitment to transparency and adherence to industry standards.

Additionally, Trade Markets utilizes advanced security measures to protect clients’ personal and financial information, which is reassuring for those concerned about online security. Overall, Trade Markets appears to be a reliable and secure option for those looking to engage in online trading. However, as with any investment, it’s important to thoroughly research and understand the risks involved before making any decisions.

The Plattform has all the basics covered, and I’ve had no issues placing trades or managing my positions. Perfect for traders who want to get started with stocks without being overwhelmed.

The platform offers a decent selection of assets and tools to track the markets. It’s straightforward enough for beginners, but I think some advanced analytics could be added for seasoned traders.