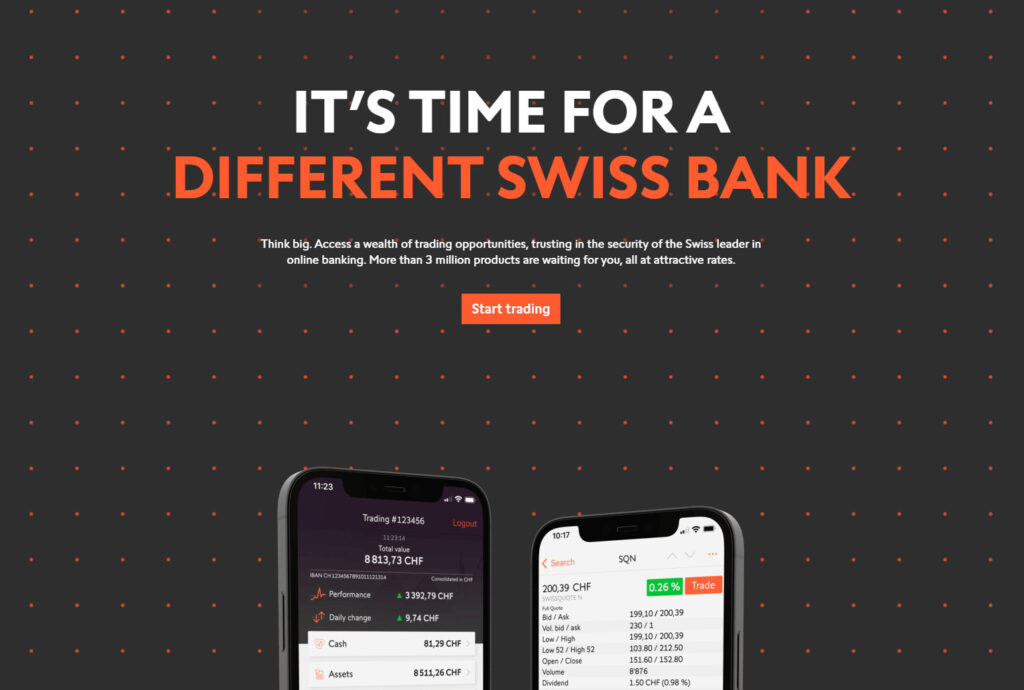

Since its 2000 initial public offering on the SIX Swiss stock exchange, Swissquote (SIX: SQN), which was founded in 1996, has developed into a well-known banking group. Swissquote had 410,000 client accounts as of its H1 2021 report, and its subsidiaries that are governed in Europe and Asia total CHF 50.2 billion.

Swissquote Bank, which has its headquarters there, provides traders with access to more than 2.5 million products, including shares, ETFs, funds, bonds, warrants, futures, forex, options, and other securities. Swissquote also provides thorough wealth management and advisory services.

As long as they are willing to pay a premium to have their brokerage account held with a Swiss bank, traders choose Swissquote for its high-quality research and extensive multi-asset offering.

Out of the account options offered by Swissquote, the U.K. branch offers the best pricing, despite having a smaller selection of markets.

.

Trading Instruments Swissquote

The first bank to provide the option to trade underlying cryptocurrencies (non-CFDs) was Swissquote. There are a total of 23 cryptocurrencies available, including well-known digital currencies like Dogecoin, Polkadot, Cardano, and Uniswap. Swissquote is also getting ready to introduce cryptocurrency lending and staking.

eTrading vs. eForex accounts: Customers can trade cryptocurrencies along with a seemingly limitless variety of products on 60 global market exchanges using the Swissquote eTrading account offering. However, traders must use Swissquote’s eForex account, which only has 292 tradeable symbols, if they wish to trade forwards, options, forex, and CFDs. Compared to Saxo Bank and CMC Markets, which each offer over 10,000 CFDs, including forex, this is a fairly limited selection.

- Forex Trading (Spot or CFDs) Yes

- Tradeable Symbols (Total) 466

- Forex Pairs (Total) 78

- U.S. Stock Trading (Non CFD) Yes

- Int’l Stock Trading (Non CFD) Yes

- Social Trading / Copy Trading Yes

- Cryptocurrency (Physical) Yes

- Cryptocurrency (CFD) No

Fees and commissions

The appeal of having an account with a Swiss banking conglomerate is the main benefit of using Swissquote, though that comes at a slight premium. Because of this, Swissquote’s trading costs are not its strongest suit and fall short of what the cheapest forex brokers have to offer.

The commissions and spreads offered by Swissquote Ltd in the United Kingdom are different from those offered by its subsidiaries in Switzerland (Swissquote Bank Ltd) and Luxembourg (Swissquote Bank Europe SA). The U.K.-based accounts, though they have a smaller product selection, have the lowest costs and the easiest deposit requirements of the three.

Swiss branch: Although Swissquote’s eTrading account does not support forex or CFDs, its forex clients in Switzerland have three main account options to choose from. Spreads on the EUR/USD start at 1.7 pip for the Standard account, which requires a deposit of $1,000, and drop to 1.4 pip for the Premium account, which requires a deposit of $10,000.

Spreads for the Prime account start at 1.1 pips, which is slightly higher than the industry standard and requires a deposit of $50,000. Active traders have access to custom pricing, but it must be negotiated based on volume since Swissquote doesn’t provide any relevant volume tiers or pricing.

Trading fees for cryptocurrencies: Swissquote’s eTrading account charges fees that are 1% of the value of each cryptocurrency trade, 0.75% for trades over CHF 10,000, and finally 0.5% for trades over CHF 50,000. While there are no cryptocurrency custody fees, deposits of less than $500 are subject to a $10 fee.

Apps for mobile and Trading Platform

With a respectable number of research features and integrated educational content, Swissquote’s Advanced Trader mobile app is simple to use and attractively designed. However, because charting is so severely constrained, I strongly suggest the MetaTrader suite.

Overview of the apps: Swissquote provides its own Advanced Trader app as well as the MetaTrader mobile app suite (MT4 and MT5) for traders of forex and CFDs. The Swissquote app is available for Android, iOS, and Huawei smartwatches for trading stocks and cryptocurrencies.

Swissquote provides the YUH app, a passive investing app for stocks and cryptocurrencies, as part of its partnership to power PostFinance, one of the biggest financial institutions in Switzerland.

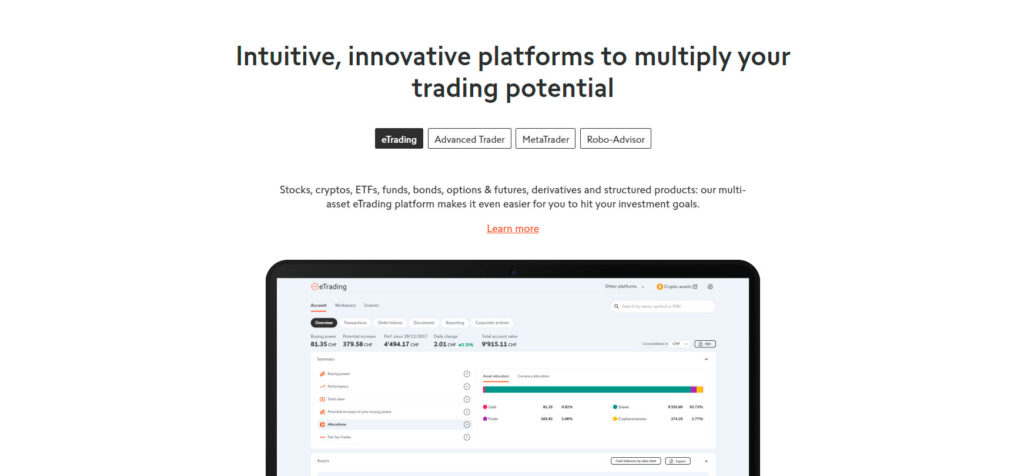

The Advanced Trader platform suite from Swissquote, which is accessible via desktop and the web, is always changing. Nevertheless, a solid substitute is the complete MetaTrader suite.

Overview of platforms: Swissquote’s Advanced Trader platform suite is available for web and desktop use on all popular operating systems. The Swissquote website serves as the platform login for its eTrading account, but only supports shares and cryptocurrencies; it does not support forex or CFDs.

The well-known MetaTrader platform suites (MT4 and MT5) created by MetaQuotes Software Corporation are also accessible through Swissquote. Swissquote provides the MetaTrader Master Edition toolkit created by FX Blue LLP, along with support for the Trading Central and Autochartist plugins, to improve the experience with the default MetaTrader desktop platform.

Market research

Swissquote offers a good selection of research materials, such as webinars, economic calendars, blog commentary, and streaming news headlines. Swissquote sets itself apart from its rivals by conducting research that is of a higher caliber than is typical for the sector.

Overview of the research: Swissquote offers Themes Trading articles, a high-quality bimonthly magazine with nearly 80 pages of technology-rich content spanning global markets, daily written articles through its Morning News series from the Newsroom section of its website. A few of Swissquote’s products, like the exchange-traded certificate for cryptocurrency, with its most recent one added in 2020, are structured with assistance from the company’s quantitative research team.

Market news and analysis: Trading Central, which includes automated chart pattern analysis and analyst commentary, is accessible to traders through Swissquote. A plugin for MetaTrader is also available for AutoChartist, a comparable service. All Swissquote platforms stream news from Dow Jones Newswire and other elite sources, and traders get free Morningstar reports. The daily videos and podcasts in Swissquote’s internal Market Talk series cover both technical and fundamental analysis.

Swissquote’s YouTube channel features a Daily Market Analysis series that is available in several languages, including English, as well as playlists of 60 previously recorded webinars.

Swissquote Education

Swissquote’s advantage in this field is its video content, which is available on its YouTube channel in the form of numerous educational videos and webinars. However, the lack of interactive lesson programs and its sparse written content result in a lackluster educational experience that cannot compete with the best forex brokers.

Learning center: The forex and CFD educational courses offered by Swissquote’s learning center include 31 videos and ten eBooks. I was happy to see that in addition to a number of platform tutorials, at least 15 instructional videos are also offered within the Advanced Trader mobile app.

Conclusion on Swissquote

Swissquote, a reputable international brand, won our prize for the best banking services in 2023 and placed among our Best in Class for crypto trading and trust score.

By using the MetaTrader platform, Swissquote’s U.K. subsidiary offers the best overall forex trading experience.

On the other hand, the Swiss-based provider of forex and CFDs is a bit of a mixed bag because forex or CFD trading is not included in its otherwise extensive multi-asset offering.

Swissquote is a good platform, constantly evolving and proposing new financial products. The only black spot is that they are very expensive, their fees are high and not flat. One can actually buy a pack of 20 flat rate transactions @ 39 CHF!!! which is ridiculously high.

In the end, it all depends on how much money one has in the account. The larger the capital the better one is treated, like any other bank. I just hoped Swissquote would be operating differently and with less greed.

Extraordinary high fees for stock and options trading, and maintanance fee on top of that. Very expensive broker in comparision to IBKR or TS. Second and third star for range of markets and options availability.