With branches in numerous countries throughout the world, LiteForex has been in the internet brokerage business for more than 15 years. The business’s European operations, which are situated in Cyprus, provide traders with a range of account types as well as FX buying, selling, and swap options, all while maintaining a low-cost model that complies with all EU financial rules.

The brokerage service provided by LiteForex Europe is built on user empowerment through investor education, improved financial markets analysis, and brokerage services that are affordable and simple to fund. The LiteForex website has outstanding financial analysis, tutorials, how-to guides, and a range of courses that will get beginner traders up to speed and provide seasoned investors the specific knowledge they need.

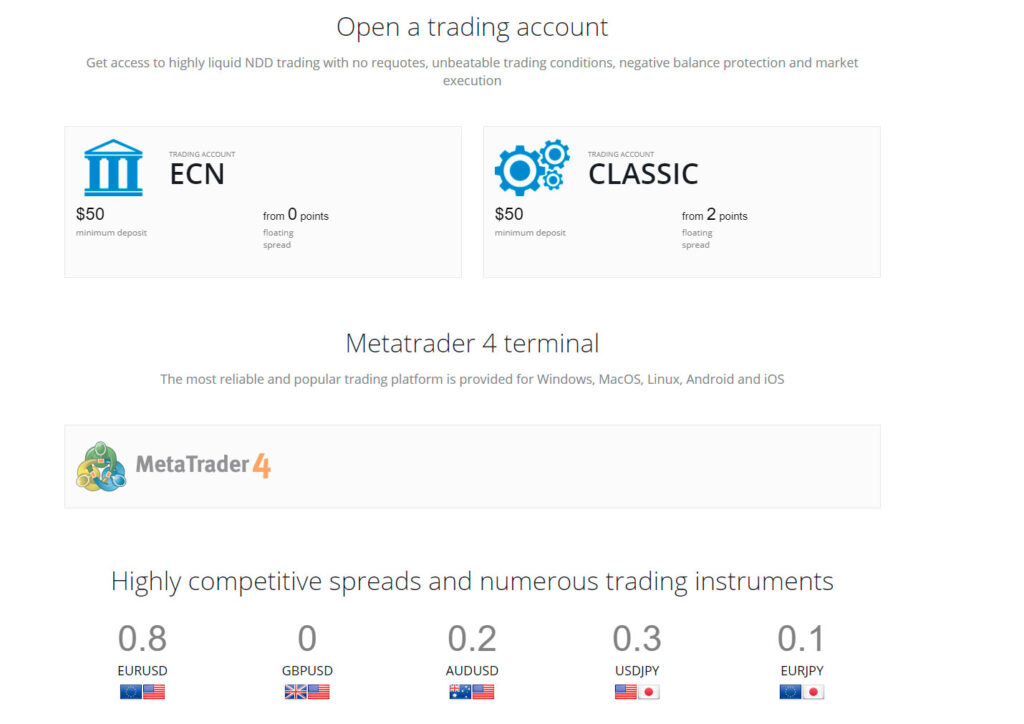

Users of LiteForex have the option of using MetaTrader 4 or MetaTrader 5 as their trading platforms. This provides consumers with access to mobile and desktop trading around-the-clock while ensuring data privacy and program stability. Excellent customer service provided by the broker (available 24/7 most days of the week) adds a further layer of dependability to an already outstanding service package.

Liteforex Pros & Cons

| ✅ Low-cost building | ⚠️ Restricted to businesspeople in 28 nations |

| ✅ Access to a variety of FX pairs with fair spreads | ⚠️ Only US-listed firms are permitted to trade shares. |

| ✅ Five days a week, excellent customer assistance is available around-the-clock. | |

| ✅ Extensive resources for financial information and trading education |

Who Is Liteforex Recommended For??

Thanks to the extensive investor education resources offered on the website and the brokerage’s partnership with Claws & Horns, which adds value, LiteForex is advised for traders of various experience levels. When using the industry-recognized MetaTrader platform, forex traders who are primarily focused on major and exotic currency pairs will profit from competitive spreads and a clear fee structure.

Liteforex Features

Access to professional analysis and trading data: The broker’s website offers a wealth of tools for investor education and financial news that are intended to give traders a competitive edge on the world’s financial markets.

Low-cost fee structure: The Classic account has a markup built into the different spreads that LiteForex provides, rather than commissions, which are included in other accounts.

Simple account setup: After registering for a new account, users can fund it with a variety of payment options and begin trading right away.

Excellent customer service: Live chat and telephone support for technical issues is available 24/7, five days a week.

- Type of Broker: Non-Advisory/Executionary Broker (Market Maker)

- Regulation & Licensing: Cyprus Securities and Exchange Commission (CySEC)

- Assets Offered: Foreign Exchange, Indices, Commodities, Shares & Cryptocurrencies

- Platforms Available: MetaTrader 4 and 5

- Mobile Compatibility: iOS, Android

- Payment Types Accepted: Credit Card, Debit Card, Neteller, Skrill

Liteforex Account Types

Classic Account

- Account Currencies: USD, EUR, GBP, PLN

- Available Leverage: Up to 1:30

- Minimum Deposit: $50

- Starting Spreads: From 2 pips

- Commission Per Trade: 0

- Decimal Pricing: Up to 5 decimals

- Trading Instruments: Foreign Exchange, Commodities, Indices, Shares, Cryptocurrencies

- Min. Lot Size Per Trade: 0.01

- Max Lot Size Per Trade: 100

- Demo Account: Yes

- Swap/Rollover Free: Yes

- Copy Trading Support: Yes

ECN Account

- Account Currencies: USD, EUR, GBP, PLN

- Available Leverage: Up to 1:30

- Minimum Deposit: $50

- Starting Spreads: From 2 pips

- Commission Per Trade: 0

- Decimal Pricing: Up to 5 decimals

- Trading Instruments: Foreign Exchange, Commodities, Indices, Shares, Cryptocurrencies

- Min. Lot Size Per Trade: 0.01

- Max Lot Size Per Trade: 100

- Demo Account: Yes

- Swap/Rollover Free: Yes

- Copy Trading Support: Yes

Liteforex Regulations

This business is a licensed broker based in Cyprus, an EU member nation in Southern Europe. The Cyprus Securities and Exchange Commission thus controls all trading and client activity. As mentioned above, in the event of brokerage liquidation, this jurisdiction provides investors with compensation up to EUR 20,000 on non-professional trading accounts.

Traders who are thinking about opening a LiteForex account should weigh the advantages and risks involved while keeping in mind that the company operates in a well-regulated environment.

Liteforex Pricing

This broker’s low cost structure is a result of the spreads it offers on its various asset classes, which also include an integrated markup. This could indicate that trading specific currency pairs ends up being less profitable. However, when compared to other online brokers who offer comparable services, the overall rates that traders can choose from are still quite reasonable. Additionally, as soon as the funds have cleared, the deposit fees are automatically reimbursed and credited to the client’s account balance.

It should be noted that LiteForex uses two different account types with slightly different cost structures. The spreads, which include a markup, are available with the Classic account at no commission. The ECN account, on the other hand, levies a flat commission of $5 per roundtrip per lot and is targeted at professionals and institutional users.

The level of leverage available varies depending on the user’s location because LiteForex operates in several different jurisdictions around the world. The maximum margin trading permitted for forex transactions is 30:1 in accordance with European Union law (the ESMA regulations, which took effect in March 2018). To traders based in other regions, this broker might provide higher ratios.

Reliability & Security at Liteforex

The trading platforms available to account holders include MetaTrader 4 and MetaTrader 5. With a wide range of features and advantages, this industry-standard software is praised for its data security features, analytics capabilities, and speedy execution times.

This broker offers a trustworthy and interesting copy trading platform that serves as a social media network. Users can observe the trades made by top-ranked account holders and copy their successful tactics in an effort to improve everyday performance.

The negative balance protection feature, which is applicable to both account types, is another advantage tied to the European Union’s financial markets rules. All retail trading accounts are protected against broker liquidation up to a limit of EUR 20,000 by the Cyprus Investor Compensation Fund.

Conclusion on Liteforex

Overall, LiteForex is a fantastic option for both amateur and experienced traders because of the variety of account types it offers and the richness of financial data that is accessible to account holders. Private investors that prioritize forex pairs and value transparency and affordable pricing will especially profit from this broker’s offering.