Blammo Ltd is a financial services company that offers a range of financial products and services, including forex and CFD trading, asset management, investment advice, and wealth management. However, it is important to note that Blammo is not a regulated forex broker, which may be a concern for traders who prioritize regulatory oversight and protections. Broker Blammo is positioning itself as a new digital asset bank, founded in February 2019, which offers simple and affordable crypto-financial products to investors all over the world. The company hides exact details about its actual physical office or founders.

While Blammo’s website is professional and informative, there is limited information available about the company’s history, ownership, and management. This lack of transparency may raise questions for potential clients about the legitimacy and credibility of the firm.

Trading Instruments

Blammo Ltd provides its clients with access to a range of trading instruments across various asset classes, including forex, commodities, indices, and cryptocurrencies. Here is a closer look at the trading instruments offered by Blammo:

- Forex: Blammo offers a range of currency pairs, including major, minor, and exotic pairs. Forex trading is available 24/5, and the broker claims to offer tight spreads and fast execution.

- Commodities: Blammo provides access to a range of commodities, including precious metals like gold and silver, energy commodities like oil and gas, and agricultural commodities like wheat and soybeans. Clients can trade these commodities as CFDs, which allows them to speculate on the price movements of these assets without owning them.

- Indices: Blammo offers its clients the ability to trade on a range of global stock indices, such as the S&P 500, the FTSE 100, and the Nikkei 225. Trading indices as CFDs allows clients to benefit from the price movements of these indices without owning the underlying assets.

- Cryptocurrencies: Blammo allows its clients to trade cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Trading cryptocurrencies as CFDs enables clients to speculate on the price movements of these digital assets without owning them.

Regulation and security

Blammo Ltd is not a regulated forex broker. While the company offers a range of financial services and trading instruments, the fact that it is not regulated may be a concern for traders who prioritize regulatory oversight and protections.

Regulated forex brokers are required to meet certain standards and adhere to strict rules to protect their clients’ interests. They are also subject to regular audits and inspections to ensure compliance with regulatory requirements. This provides traders with a level of assurance that their funds are safe and that the broker is operating transparently and in their best interests.

Without regulation, there may be no oversight of the broker’s practices, and clients may not have access to the same protections and safeguards as those provided by regulated brokers. This can increase the risk of fraud, financial mismanagement, and other unethical practices.

In terms of security, Blammo states that it employs various measures to protect clients’ funds and personal information, including encryption and secure servers. However, without regulatory oversight, it is unclear what additional security measures are in place to protect clients’ funds and data.

In conclusion, the fact that Blammo is not a regulated forex broker may be a concern for traders who prioritize regulatory oversight and protections. It is important for traders to conduct their own research and due diligence before opening an account with any broker, particularly those that are not regulated. This includes thoroughly researching the broker’s security measures and policies to ensure the safety of their funds and personal information.

Trading Terms and Accounts

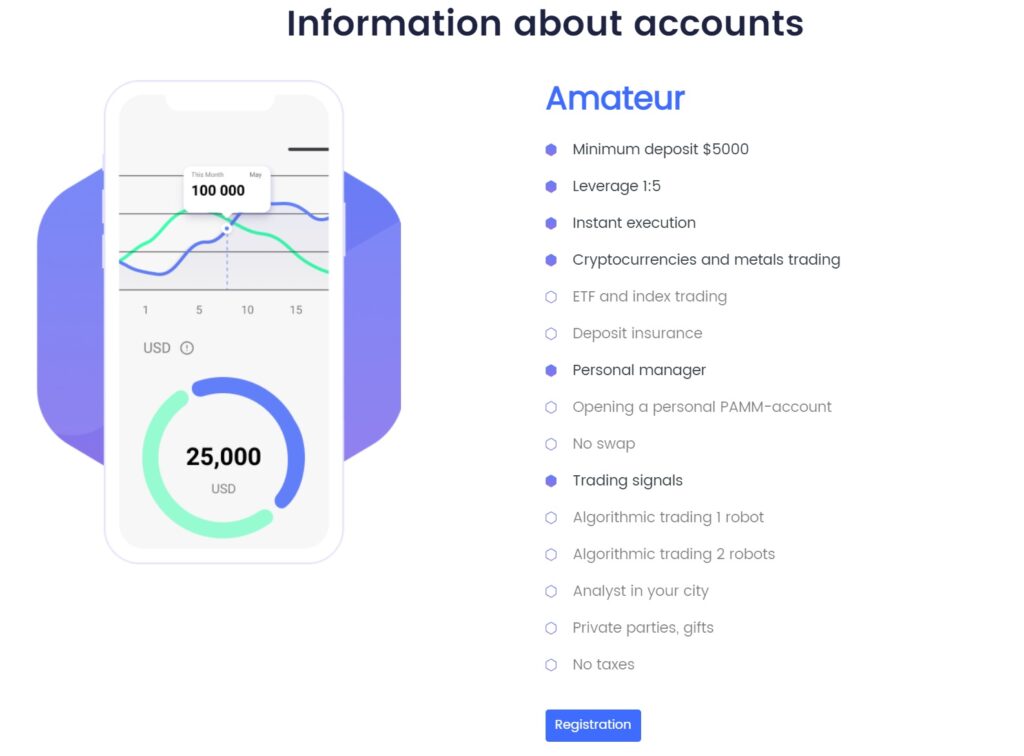

Blammo offers a range of account types to suit different trading styles and preferences. Each account type has different trading conditions, such as minimum deposit requirements, spreads, and leverage.

The broker offers its clients 6 basic account types. From “Beginner” account – with a minimum deposit of $500, leverage 1:5 and trading only Crypto and Metals. Up to accounts of Platinum type – where the minimum deposit is 1000 times bigger – $500,000, leverage 1:20, trading in all types of assets, the availability of personal managers, trading signals and deposit insurance is available.

Trading Platforms

Blammo offers its clients access to popular trading platforms, including the MetaTrader 4 (MT4) platform, which is a popular choice among forex traders due to its advanced charting tools, custom indicators, and automated trading capabilities. The company also provides a web-based platform, which allows traders to access their accounts and trade from any device with an internet connection.

Leverage, Spreads and Commissions

Blammo provides its clients with access to leverage up to 1:500, which can amplify profits but also increases the risk of losses.

Blammo claims to offer competitive spreads, starting from as low as 0.1 pips for major currency pairs. The broker does not charge any commissions on trades, which can help reduce trading costs.

Deposit and Withdrawal Methods

Blammo supports a range of deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. The broker claims to process withdrawals within 24 hours, but this may depend on the withdrawal method and processing times of third-party payment providers.

| Advantages of Trading with Blammo Markets | Drawbacks of Trading with Blammo Markets |

|---|---|

| ✅ Diverse range of trading instruments | ⚠️Lack of regulation, which may be a concern for traders who prioritize regulatory oversight and protections. |

| ✅ Competitive spreads, starting from as low as 0.1 pips for major currency pairs. | ⚠️ Limited information about the company’s ownership and management. |

| ✅ Leverage up to 1:500, allowing traders to take larger positions in the market without having to put up the full amount of capital. | ⚠️ No negative balance protection, which means that traders could potentially lose more than their initial deposit. |

| ✅ Access to popular trading platforms, including the MetaTrader 4 (MT4) platform and a web-based platform. | ⚠️ No segregated client accounts, which means that client funds are not kept separate from the broker’s operating funds. |

| ✅ Multilingual customer support available 24/5 via phone, email, and live chat. | ⚠️Limited educational resources and research tools for traders looking to improve their trading skill |

| ⚠️Inactivity fees for accounts that have not been used for a certain period of time. |

Conclusion on Blammo Markets

Blammo is a forex broker that offers a range of trading instruments, competitive spreads, and leverage up to 1:500. The broker provides access to popular trading platforms and multiple deposit and withdrawal methods, and offers multilingual customer support. However, Blammo is not regulated and lacks transparency about its ownership and management.

The lack of negative balance protection and segregated client accounts may also be a concern for some traders. Additionally, the broker has limited educational resources and research tools. It is important for traders to carefully consider the advantages and disadvantages before deciding to open an account with Blammo, and to conduct their own research and due diligence to ensure the broker is suitable for their trading needs and preferences.

I invested the minimum amount as suggested by the agent and made some profit. Alleged Account Managers started to put extreme pressure on me to invest more. I asked to withdraw my investment and they ignored me.

Very clever swindlers, they hide under the guise of helping you to take from you