AAFXTrading is a well-known broker that has impressed the financial sector since its establishment in 2014 and can support its double-digit annual growth rate.a brand that won the Best Asian Broker award in 2016 and has well over 100,000 traders as members. Traders value AAFX for its compliant custody over their funds and information, a wealth of trading tools hosted on the MT4 platform, and a vast library of educational resources as much as they do for its distinctive deposit bonuses and trading conditions. AAFX is based in St. Vincent and the Grenadines and is governed by the territory’s Financial Services Agency.

AAFX is equipped to serve a growing global market of traders who want to take advantage of some of the highest leverage available along with a wide variety of tradeable instruments by offering its products in more than 20 languages. AAFX traders attest to low spreads in a setting of their choosing, including on currency pairs and cryptocurrencies as well as stocks, indices, and commodities, as both fixed and variable spreads accounts are offered. Given its superior combination of products and services, AAFX is one of the most accessible brokers available, with no commissions and a low minimum deposit.

Pros & Cons AAFX TRADING

| ✅ Swap-free and commission-free trading accounts | ⚠️ Limited resources for analysis and research |

| ✅ Spreads can be fixed or variable. | ⚠️ VIP accounts require a minimum deposit of $20,000 |

| ✅ High Leverage US Clients up to 2000:1 Accepted | |

| ✅ Up to 35% in deposit and re-deposit bonuses |

Who Should Use AAFX TRADING?

Another advantage of being registered and regulated in St. Vincent and the Grenadines is that traders from all over the world may join up to become members of AAFXTrading. This is in addition to a vigilant and strict regulating body. Notably, this also includes the US. The decision to trade with AAFX is therefore largely on one’s perception of its trading conditions and tools, which are among the best in the world but are perhaps most effective when used by experienced traders due to the lack of regional constraints. Traders may select the sort of cost structure they desire and have access to leverage up to 2000:1 with the ECN and Fixed accounts’ variable and fixed spread options, respectively.

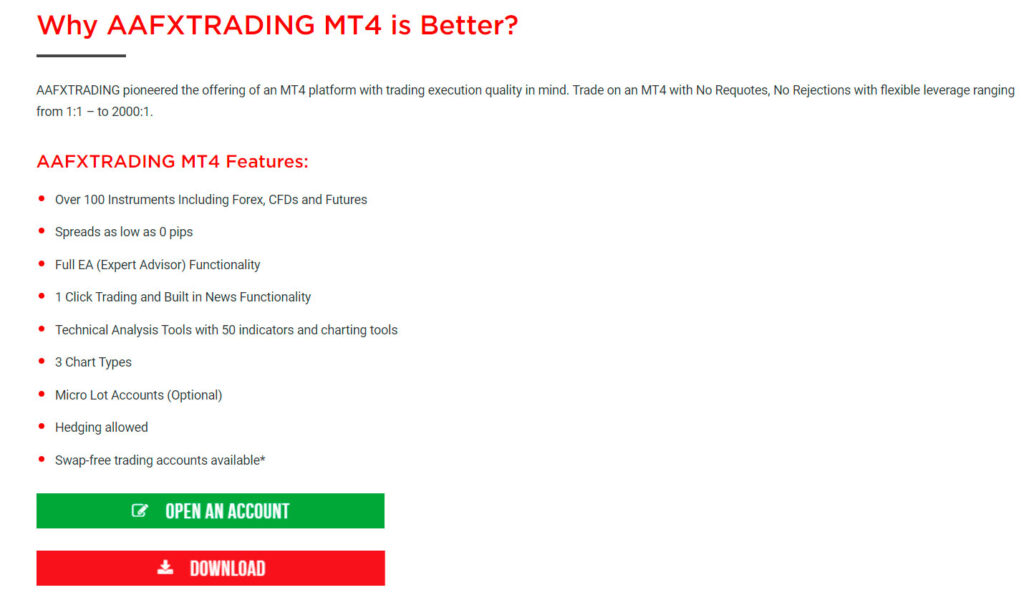

AAFX depends solely on MetaTrader 4, which many already perceive to be a sophisticated trading platform, to exercise this level of control and trading power. Because the minimum deposit is reasonable and the broker encourages new traders to use a free sample account before entering the market, novice traders may also benefit from AAFXTrading. The extensive instructional collection of films on common trading topics is also intended to assist novice to intermediate traders in acquiring the information and experience necessary to get a competitive edge on the world’s financial markets.

AAFX TRADING Features

High Leverage is Available: Depending on the instrument, AAFXTrading traders with any account type can take advantage of leverage of up to 2000:1. This allows clients to take larger positions across global assets and gives those with a higher risk tolerance the option to successfully execute their trading strategies.

No Fee Model: Since every account type offered by AAFXTrading is commission and swap-free, traders simply need to think about spreads, choosing either fixed or variable spreads depending on the account one selects.

Wealth of Assets: Users of AAFXTrading have access to a variety of asset classes that may be traded, including forex, cryptocurrencies, commodities, indices, and stocks CFDs, all of which enable almost any trading technique.

US customers Welcome: AAFXTrading is able to provide its services to traders globally, including US investors, thanks to its regulatory standing in St. Vincent. All traders’ funds will be placed in separate Tier 1 bank accounts, regardless of where they are from.

Deposit bonuses: A one-time new trader incentive gives 35% on top when a new trader starts up and invests $500; for current traders who re-deposit $500 or more, the bonus can increase to another 25%. There is a trading volume minimum for these deposits before withdrawals are permitted.

- Type of Broker: ECN/STP Broker

- Regulation & Licensing: St. Vincent & the Grenadines Financial Supervisory Authority (SVGFSA)

- Accepted Jurisdictions: All

- Assets Offered: Currencies, Commodities, Indices, Stocks, Metals, Bonds, Cryptocurrencie

- Platforms Available: MetaTrader 4 (Desktop, Web, Mobile)

- Mobile Compatibility: iOS, Android

- Payment Types Accepted: Credit/Debit Card, Bank Transfer, Skrill, Fasapay, Neteller, Bitcoin, Ethereum, Webmoney, Western Union, Payza, Moneygram

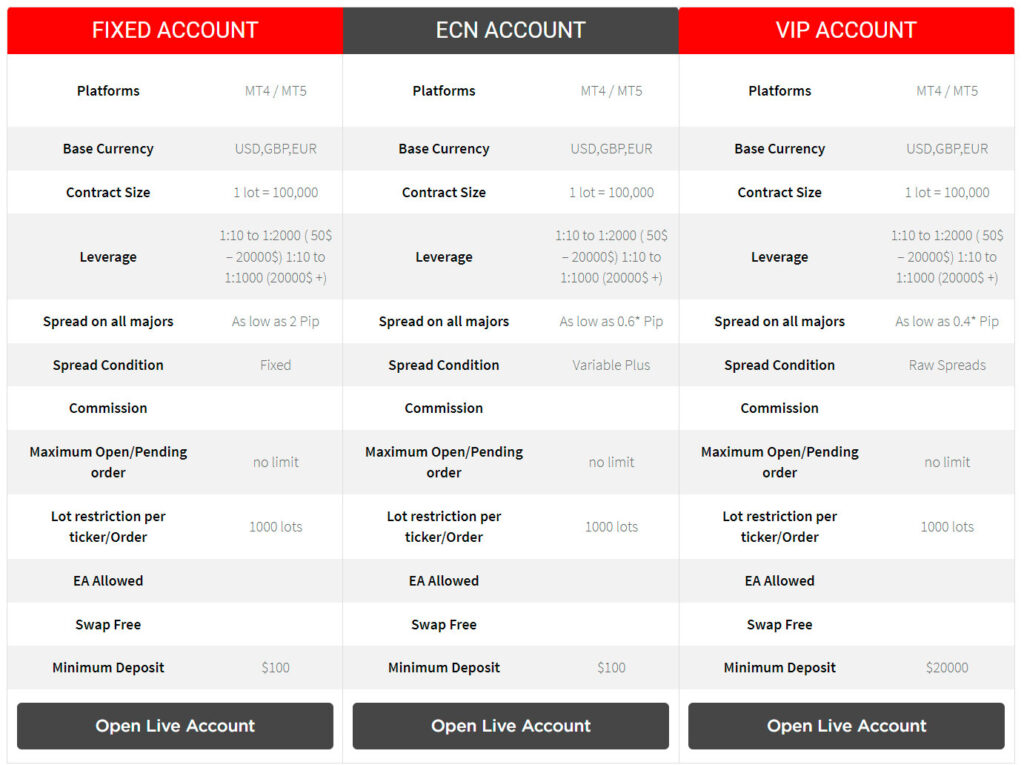

AAFX TRADING Account Types

ECN Account

- Account Currencies: USD, EUR, GBP

- Available Leverage: Up to 1:2000

- Minimum Deposit: $100

- Starting Spreads: From 0.2 pips

- Commission: Per Trade 0

- Decimal Pricing: Up to 5 decimals

- Swaps/Rollovers: Yes

- Trading Instruments: 42 FX Pairs 5 Commodities 11 Indices 197 Stocks 1 Cryptocurrency

- Min. Lot Size Per Trade: 0.01

- Max Lot Size Per Trade: 1000

- Demo Account: Yes

- Swap/Rollover Free: Yes

- Copy Trading Support: Yes

FIXED Account

- Account Currencies: USD, EUR, GBP

- Available Leverage: Up to 1:2000

- Minimum Deposit: $100

- Starting Spreads: From 2 pips

- Commission: Per Trade 0

- Decimal Pricing: Up to 5 decimals

- Swaps/Rollovers: Yes

- Trading Instruments: 42 FX Pairs 5 Commodities 11 Indices 197 Stocks 1 Cryptocurrency

- Min. Lot Size Per Trade: 0.01

- Max Lot Size Per Trade: 1000

- Demo Account: Yes

- Swap/Rollover Free: Yes

- Copy Trading Support: Yes

VIP Account

- Account Currencies: USD, EUR, GBP

- Available Leverage: Up to 1:2000

- Minimum Deposit: $20000

- Starting Spreads: From 0 pips

- Commission: Per Trade 0

- Decimal Pricing: Up to 5 decimals

- Swaps/Rollovers: Yes

- Trading Instruments: 42 FX Pairs 5 Commodities 11 Indices 197 Stocks 1 Cryptocurrency

- Min. Lot Size Per Trade: 0.01

- Max Lot Size Per Trade: 1000

- Demo Account: Yes

- Swap/Rollover Free: Yes

- Copy Trading Support: Yes

AAFX TRADING Regulations

AAFXTrading is licensed and regulated by a financial body with strict standards and access to markets that are not geographically constrained in order to provide traders with the best possible service. The St. Vincent and the Grenadines Financial Services Agency, a regulatory authority, has awarded AAFX its seal of approval and the right to service international traders with the same safeguards and assurances available to brokers operating in a single country. The strictest security standards for client data in all forms, Know Your Customer (KYC) and Anti Money Laundering (AML) procedures, and segregation of client money from the broker’s own operating funds are all requirements for SVGFSA licensing and regulation.

AAFX TRADING Pricing

AAFXTrading excels in providing investors with low cost trading services by adopting a concept that eliminates fees from all accounts while also include swaps in this wholesale exemption. That’s a rather uncommon fee-free offer that might save traders a lot of money when they open and hold overnight positions. Because brokers often have to pay their own costs associated with linking traders to liquidity providers, this may leave potential traders wondering how AAFX generates revenue. This is done solely through the spread, which, depending on the kind of account, is either variable starting at 0.2 pips or set starting at 2.0 pips.

AAFX offers traders complete access to any of its marketplaces for just $100 in terms of the minimum deposit. However, those who want the VIP account must deposit at least $20,000 in order to do so. Leverage up to 2000:1 on deposits and balances up to $500,000 will be available for this greater sum before it is lowered to 1000:1, whereas the ECN and Fixed accounts (with a $100 minimum deposit) experience reduced leverage once their balances hit $20,000. A specific account manager is also assigned to the VIP account. Although AAFX explicitly declares that it won’t charge for deposits or withdrawals or for inactivity fees, it is important to consider additional costs to which traders may be subject.

User Experience with AAFX TRADING

The first signup process for all users of AAFXTrading is straightforward and just requires them to fill out a few simple form fields. Before being able to register a demo account, obtain access to the simplified AAFXTrading interface, and practice in real markets, new traders will just need to provide their name, email address, and phone number. The dashboard has a logical arrangement of buttons on the left and top that provide access to the deposit and withdrawal pages, My Documents, a location to change trade and account settings, active promotions, as well as daily news, reports, education, and more.

Conclusion on AAFX TRADING

AAFXTrading is a reputable and award-winning CFD broker, but it didn’t achieve its success by offering products that were already on the market. Instead, AAFX stands for one of the more attractive trading environments that is both regulated and licensed and available from anywhere in the world. This is demonstrated by the fact that there are no fees, no swaps, and up to 2000:1 leverage accessible even with a $100 minimum deposit. Customers will like having the option to choose between fixed and variable spreads, further expanding their options while trading with AAFX.

Customers will also value the opportunity to receive a bonus on their initial and subsequent deposits of at least $500. This entire combination of trade value is difficult to surpass. Although more research resources and expert analysis would be appreciated, traders will discover that the customer service and instructional materials more than make up for this little flaw. With 260+ tradeable assets, acceptance of cryptocurrencies as a financing mechanism, much better trading conditions, and a wide range of options for members, AAFX stands out for what it has to offer.

The trading platform is decent, but I have faced occasional issues with order execution and slippage during volatile market conditions. The spreads are generally competitive, but I would appreciate more transparency in their fee structure. Customer support has been responsive, although there have been instances where their responses were not as comprehensive as expected.

I have had a disappointing experience with AAFX Trading. The trading platform is unreliable and frequently experiences downtime or slow performance. The spreads are wider than advertised, and I’ve encountered issues with order execution delays and requotes. Customer support has been unresponsive, and it has been a struggle to get my concerns addressed. Based on my experience, I cannot recommend AAFX Trading.